During the early hours of Monday, April 25th, the state of the crypto market was quite humdrum. Barring a couple of exceptions like STEPN and Apecoin, most other coin movements lacked vitality.

However, as the day progressed, this mood flipped completely. On the news of Musk’s Twitter acquisition deal getting sealed, Dogecoin started pumping. The token that was down by 5% when the day began, was already up by more than 30% by EOD.

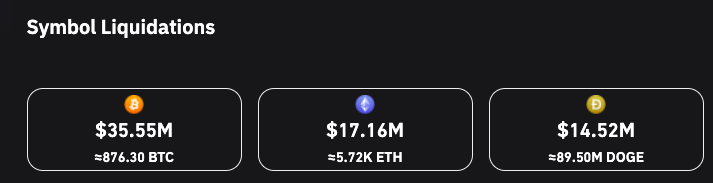

Consequentially, Dogecoin’s liquidation numbers saw a massive spike, and traders with short positions open started getting ‘rekt.’ On the whole, over the past 12-hours, close to 90 million DOGE worth almost $15 million had been liquidated. Apart from Bitcoin and Ethereum, no other token’s wipe-out numbers were as high as DOGE’s in the said period.

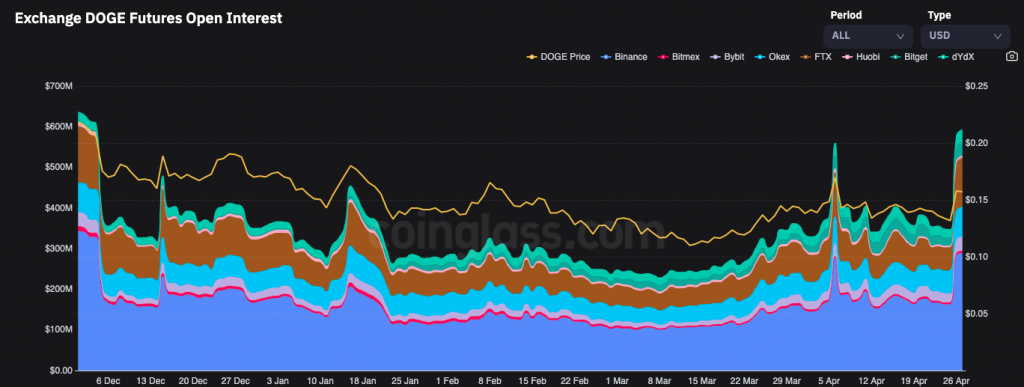

At press time, Dogecoin’s Open Interest was at its multi-month high. After registering a jump from $347 million to $593 million in less than a day, DOGE’s OI was at par with the levels noted back in December last year. Additional money flowing into the market essentially implies that traders are still capitalizing on the token’s price movements.

Outlining the sentiment flip in the DOGE market

Right after news of the Musk deal broke, traders started longing for DOGE. As a result, the long: short ratio stood >1. However, at press time, the number had already dipped below 1 and stood at 0.92. This means that the number of short positions opens currently supersede their long counterparts. This hints toward the fact that the sentiment is gradually flipping from bullish to bearish.

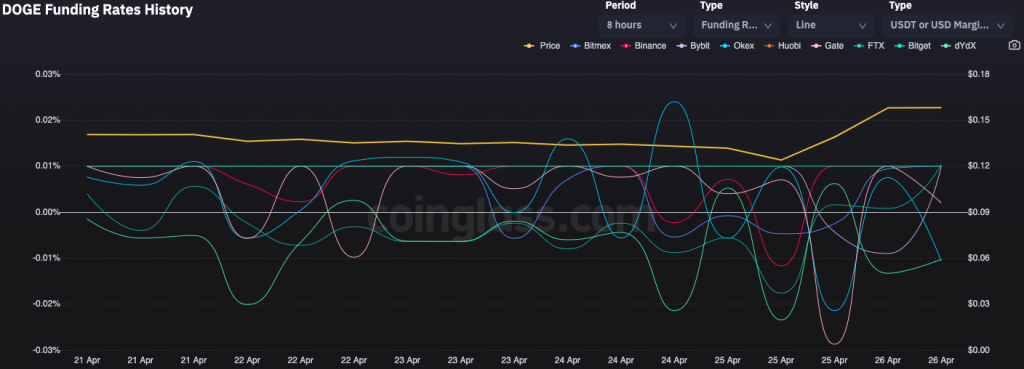

Further, the funding rate on DEXes [dYdx] and CEXes [Okex] had started slipping into the negative territory. Gate’s funding rate curve was also seen heading down south at press time, supporting the aforementioned bearish narrative.

On major exchanges like FTX and Binance, however, the number was mildly positive, hovering in the 0.01% to 0.1% range.

Even so, can the token’s bullish stint continue?

From a technical perspective, DOGE is primed to incline. It just freed itself from the shackles of its falling wedge. Per analyst Ali Martinez, “DOGE appears to be heading to $0.24.” The same would essentially translate into a 50% rally from its current price.

The bullish thesis would, however, get invalidated if DOGE falls below its $0.13 support.

So, even though the current trader sentiment in the Dogecoin market is lukewarm bearish, DOGE does make a strong case to incline from a technical perspective.